How Document Intelligence is Transforming Compliance and Risk Management

July 11, 2025

In today's business climate, regulatory compliance and risk management have become massive undertakings. Organizations face ever-expanding regulations, detailed documentation requirements, and hefty penalties for mistakes. If U.S. regulation were a country, it would rank as the world’s eighth-largest economy, and American businesses spend an average of $10,000 per employee just to meet compliance mandates. Compliance workloads are surging—risk and compliance professionals report spending over half their time identifying risks (56%) and monitoring compliance (52%). The cost of falling short is even higher: data breaches cost on average $220,000 more when a compliance failure is involved, and major regulatory fines can reach into the billions (e.g. a recent GDPR fine of €1.2B).

In this landscape, businesses are looking to technology for relief. Document Intelligence—the application of AI to digitize and understand documents—is emerging as a game-changer that can streamline compliance workflows and bolster risk management programs. It promises to automate labor-intensive tasks, improve accuracy, and surface insights from unstructured data in ways previously not possible with manual methods.

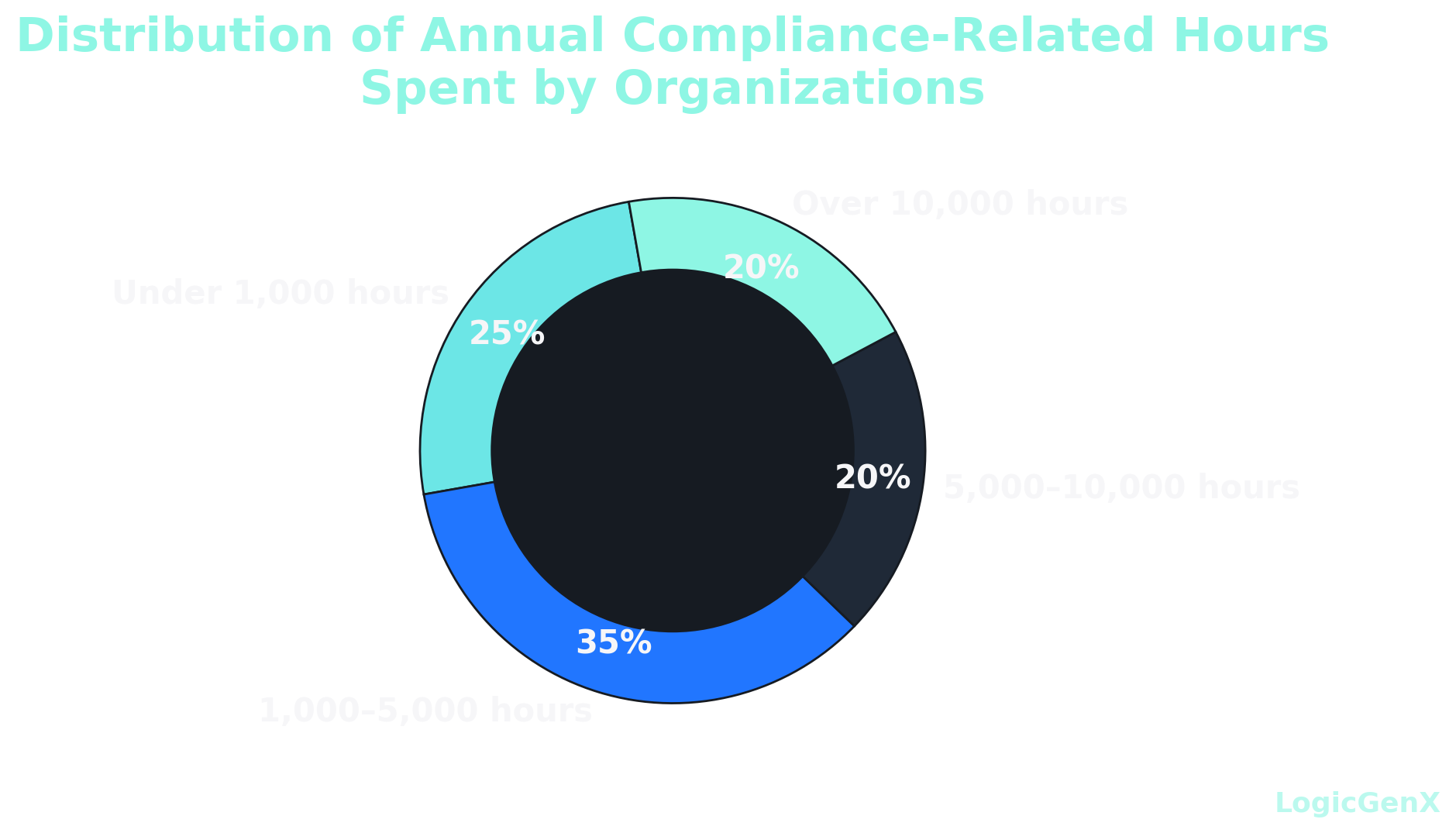

Figure: Survey data showing the distribution of annual compliance-related hours spent by organizations. A significant 20% of businesses spend over 10,000 hours per year on compliance activities, while only 25% spend under 1,000 hours (Source: Drata, 2024).

Figure: Survey data showing the distribution of annual compliance-related hours spent by organizations. A significant 20% of businesses spend over 10,000 hours per year on compliance activities, while only 25% spend under 1,000 hours (Source: Drata, 2024).

What is Document Intelligence?

Document intelligence is an AI-driven approach to document processing that goes beyond simple scanning or OCR. It leverages optical character recognition (OCR) for reading text, machine learning (ML) for pattern recognition, and natural language processing (NLP) for understanding context. Document intelligence systems can classify documents, extract key data points, and even interpret complex language in contracts or forms. The output is structured, actionable data—metadata, summaries, flags—along with a clear view of each document’s context and meaning. This is a core component of broader “document understanding” initiatives in enterprise AI.

Importantly, document intelligence tools are designed to handle the types of unstructured data (emails, reports, PDFs) that dominate compliance and risk workflows. Analysts estimate that 80–90% of new enterprise data is unstructured, yet only ~18% of organizations are effectively leveraging that unstructured content. Document intelligence bridges this gap by turning a formerly untapped trove of text into structured insights. According to industry reports, 63% of Fortune 250 companies have already implemented intelligent document processing (IDP) solutions, with finance leading adoption.

Streamlining Compliance through AI

Compliance management involves continuous documentation, review, and reporting to prove adherence to laws and standards—a process historically dominated by manual paperwork and tedious checks. Document intelligence is dramatically improving these processes in several ways:

Automated Document Classification & Data Extraction

Instead of compliance staff sifting through piles of files, AI models can automatically classify incoming documents (invoices, contracts, policy forms, etc.) and extract the required information for compliance records. This ensures nothing is misfiled or overlooked. For example, an intelligent platform can recognize a contract and pull out key clauses (payment terms, renewal dates, parties’ obligations) in seconds. This saves countless hours of manual review and ensures that critical terms related to compliance (like regulatory obligations or expirations) are not missed.

Real-Time Monitoring and Alerts

Document AI systems enable a shift from reactive to proactive compliance. Rather than periodic manual audits, AI can continuously monitor documents and communications for compliance issues. Bots can review contracts, flag anomalies or prohibited language, and check documents against regulatory rules as they are created. For instance, if a policy document lacks a required clause or a customer onboarding form is missing a KYC element, the system can immediately flag it for correction. This real-time oversight means fewer surprises—issues are caught before they become violations.

Policy and Regulation Tracking

Keeping up with regulatory changes is itself a major burden. AI tools can ingest updates from regulators (new laws, guidelines, sanctions lists) and automatically compare them with the organization's current documents and procedures. This helps compliance teams quickly identify what policies or contracts need updating to stay compliant. In effect, AI acts as a watchdog, scanning for any misalignment between evolving regulations and a company’s documentation.

Audit Trail and Documentation

Compliance often requires showing auditors the “paper trail”—who signed what, when a document was modified, etc. Document intelligence solutions excel at maintaining detailed audit logs and metadata. They capture timestamps, versions, approvals, and can generate compliance reports on-demand. According to a World Economic Forum survey, 75% of executives believe that by 2025, AI solutions will be able to perform 30% of corporate audit work. In practice, document AI helps compile evidence for audits much faster, ensuring that organizations can prove compliance with less scramble.

Retention and Disposal Compliance

Many regulations (like data privacy laws or financial rules) mandate how long records must be kept and when they should be disposed of. Document intelligence can automatically tag documents with creation dates and categories, then notify or execute disposition when retention periods expire. A case study in banking showed that an AI-driven document processing solution was able to scan ~50 million pages of records, determine retention requirements, and schedule dispositions to meet a strict 7-year rule—all far faster than a manual team could. Automating this ensures organizations meet regulatory deadlines for record-keeping and deletion, minimizing compliance risk.

Quantifiable Results

Routine compliance tasks that used to tie up human staff for days can now be completed in minutes or hours by AI. Studies show that implementing intelligent document processing can cut document handling time by over 50% and reduce error rates by more than 50% (with top-tier systems reaching 99% accuracy). By one estimate, about 70% of data entry and document review tasks in compliance can be automated with current IDP technology.

Real-world example:

A financial institution, faced with a large regulatory document backlog, used an AI document platform to reduce the required team from 100 full-time employees to just 5, completing the project within the deadline and at a fraction of the cost. The project went from kickoff to full production in only two months. Such outcomes underscore why 54% of compliance staff believe AI/ML will improve compliance while cutting costs, and nearly 40% of teams plan to invest in new compliance tech to enable more proactive, continuous compliance.

Enhancing Risk Management and Insights

Risk management, like compliance, is heavily driven by documents and data—insurance claims, incident reports, financial disclosures, vendor assessments, audit findings, and more. Document intelligence is proving equally transformative in this domain by enabling faster risk identification, deeper analysis, and more resilient operations.

Early Risk Detection

AI document analysis can comb through vast datasets of reports, transactions, and communications to spot patterns or anomalies that signal risk. For example, machine learning models can review thousands of expense reports or transaction records and flag suspicious patterns for fraud (AML) or compliance violations. This capability is vital for financial crime compliance—intelligent systems can cross-check customer documents and flag high-risk profiles or behaviors in real time, vastly improving Know-Your-Customer and Anti-Money Laundering efforts.

Holistic View of Risk Documents

In many organizations, risk-related information is siloed across departments and document repositories. An AI-powered document platform can serve as a central hub that ingests and links all risk documentation, breaking down silos. This visibility means emerging risks or recurring issues can be spotted with cross-document intelligence, supporting a more integrated risk management approach as emphasized by frameworks like COSO ERM and ISO 31000.

Faster Analysis and Decision Making

Time is critical in risk response. Document intelligence dramatically accelerates the analysis phase when a risk event or regulatory change occurs. What might take a team of analysts weeks to review manually, an algorithm can summarize in minutes. Organizations using AI document processing have achieved 95%+ straight-through processing of certain risk documents with no human intervention, greatly accelerating risk assessments.

Improved Consistency and Compliance to Standards

Risk management standards and regulations (like Basel IV for banks, Solvency II for insurers, or SOC 2/ISO 27001 for information security) demand consistent documentation and reporting. Document AI helps enforce that consistency, ensuring every risk report includes the required sections and all necessary forms are present. Automation not only saves time but also reduces variability and ensures fairness.

Auditability and Transparency

AI systems log every action. When decisions are made or exceptions approved, the system can maintain a transparent trail—crucial for regulatory reporting and frameworks like the EU AI Act, which emphasizes explainability and human oversight in AI systems. Responsible deployment of document intelligence—with governance and fallback procedures—enhances risk programs by making them more robust and transparent, not just faster.

Additional benefits:

Organizations using document intelligence report being able to analyze far more data with the same staff, focusing experts on high-risk cases. During the COVID-19 pandemic, many firms handled a surge in digital documents by adopting IDP solutions, which led not only to faster processing but also to better collaboration (54% of firms) and greater flexibility (33%).

Alignment with Compliance Frameworks and Standards

Implementing document intelligence helps meet specific regulatory frameworks and industry standards, including:

Financial Reporting & SOX

Under Sarbanes-Oxley (SOX) and related financial regulations, companies must maintain meticulous documentation of their financial controls and reporting processes. Document intelligence can automate organization, testing, and verification of control documents, cross-referencing numbers and required sign-offs. This not only speeds up SOX compliance but significantly reduces the risk of audit findings. A 2025 study notes that context-aware document AI is a fundamental evolution in automating regulatory compliance.

Privacy Regulations (GDPR, CCPA, HIPAA)

Privacy laws require strict control over personal data in documents. Document AI can automatically identify and classify personal identifiable information (PII), enabling fast response to subject access requests and enforcing data minimization and retention. For HIPAA, it screens for protected health information and ensures correct handling. 65% of compliance professionals believe that automation reduces the complexity and cost of compliance—especially in data privacy.

Industry Standards (ISO 27001, PCI-DSS, FDA 21 CFR Part 11)

Most standards require documented controls and evidence. Document intelligence ensures that evidence is collected and organized automatically. For example, AI can continuously pull logs, policies, and minutes for ISO 27001 or check diagrams for PCI-DSS. This supports “compliance by design” and reduces audit scrambles.

Risk Management Frameworks (COSO ERM, ISO 31000, Basel III/IV)

Frameworks like COSO ERM and ISO 31000 emphasize information, communication, and monitoring. Document intelligence aggregates risk indicators from incident forms, complaints, and audit reports, providing a dashboard of emerging risks. For Basel III/IV, AI helps compile and verify reports efficiently, making it easier to meet deadlines and have confidence in data accuracy.

In short, document intelligence acts as a force multiplier for compliance and risk frameworks. It doesn’t replace skilled professionals but augments their capabilities—letting them focus on strategy and judgment calls, with AI as a decision-support tool.

Data-Driven Results and ROI

The transition to AI-powered document processing is backed by compelling data and ROI:

- Operational Efficiency: Companies report processing times cut by 50–90%. For example, a logistics firm reduced document processing time from 7 minutes per file to under 30 seconds (a >90% reduction) by using an IDP solution.

- Cost Savings: Automating manual work delivers 30–200% ROI in the first year; about 70% of manual data entry can be eliminated. Preventing compliance slip-ups avoids fines and legal costs.

- Accuracy and Risk Reduction: Top-tier systems achieve error rate reductions of over 50%. 93% of executives say AI “removes human error” in compliance and makes tasks more efficient.

- Scalability and Flexibility: AI can scale to meet surges in workload and adapt quickly to new regulations, far better than manual teams.

- Intangible Benefits: Employees focus on more meaningful work, and 78% of companies using AI in compliance see improved stakeholder perception.

Budgets for compliance technology are rising: In 2023, firms were twice as likely to increase compliance tech budgets as to cut them, and nearly every organization (95%) now uses some form of automation in risk and compliance.

Conclusion: A New Era of Compliance & Risk Management

Document intelligence is transforming compliance and risk management from necessary burdens into strategic advantages. By harnessing AI to read, understand, and organize documents, businesses can stay ahead of regulatory demands, spot risks early, and gain actionable insights.

Those that deploy document intelligence position themselves not only to avoid fines and crises, but to truly embed compliance and risk awareness into daily operations. This means agility in the face of change—when regulations evolve or new risks emerge, AI-powered systems can rapidly adjust.

In a world where compliance requirements grow more complex every day, document intelligence offers a way to simplify and succeed. It allows businesses to focus on growth and innovation, rather than drowning in paperwork, secure in the knowledge that an intelligent digital assistant is handling the heavy lifting.

At LogicGenX, we specialize in helping businesses implement AI-powered document processing solutions tailored to compliance and risk needs. With our expertise in Document Intelligence, OCR, and cloud automation, we enable organizations to set up these transformative capabilities quickly and securely. By partnering with us, your organization can modernize compliance operations and confidently navigate the complex risk landscape—turning challenges into opportunities.

References

- Zluri – “Key Compliance Statistics & Insights 2025”

- Drata – “115 Compliance Statistics You Need to Know (2025)”

- World Economic Forum – “2023 Global Risk Report”

- IBM Security – “Cost of a Data Breach Report 2023”

- Instabase – “Minimize Compliance Risk with Intelligent Document Processing”

- Docsumo – “Document AI for Efficient Compliance and Risk Management”

- Archer IRM – “AI & the Future of Compliance and Risk Management”

- ThoughtTrace – “How Document Intelligence Supercharges Regulatory Compliance & Risk Management”